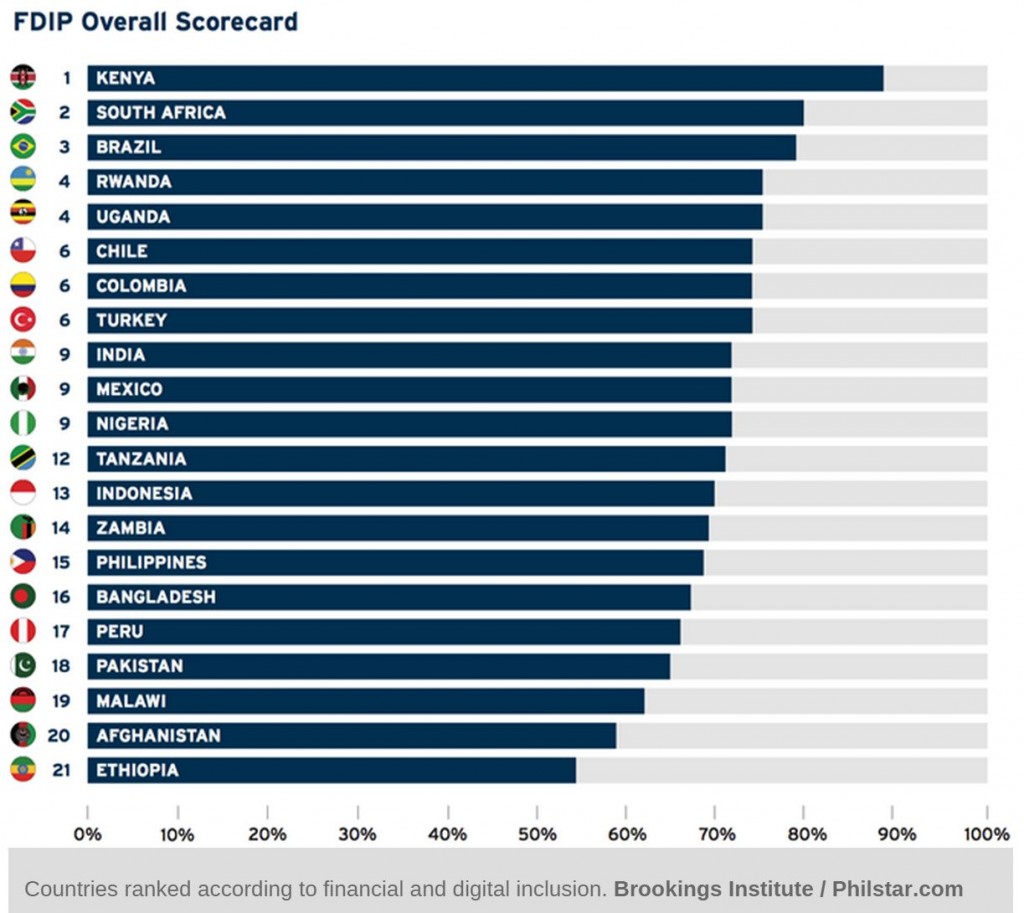

MANILA, Philippines – Washington-based think tank Center for Technology Innovation (CTI) has ranked the Philippines 15th out of 21 countries in terms of access and usage of affordable financial services.

The Philippines earned 68 percent of the total possible points based on the 2015 Brookings Financial and Digital Inclusion Project (FIDP) Report prepared by John Villasenor, Darrell West, and Robin Lewis.

The FIDP report is the first of a series of annual reports examining financial inclusion activities around the world. It ranked the 21 countries which have committed to improving financial access and usage using 33 indicators spanning four dimensions: country commitment, mobile capacity, regulatory environment and adoption.

The Philippines placed eighth with a score of 94 percent in country commitment and seventh place in terms of regulatory environment with a score of 89 percent.

It received its lowest score of 40 percent to place 15th in the adoption dimension as it got low marks in financial institution account penetration, debit and credit card use as well as mobile money use.

In terms of mobile capacity, the Philippines got a score of 89 percent to rank eighth. The Bangko Sentral ng Pilipinas has permitted mobile network operators Smart Communications and Globe Telecom to offer their respective mobile money services.

According to the report, the Philippines developed two of the earliest mobile financial services schemes with Smart’s Smart Money launched in 2001 and Globe’s GCash introduced in 2004.

As of 2014, there were about 111 mobile subscriptions per 100 people in the Philippines as individuals could hold more than one subscription. Registered e-money accounts increased 34 percent to about 27 million in 2013.

The number of micro-banking offices increased to 465 in 2013 from 370 in 2012 and the number of local government units (LGUs) that did not have access to a bank branch but did have access to a micro-banking office increased to 56 from 50.

Of the 604 unbanked LGUs in 2013, 398 had access to alternative financial services providers – so only four percent of the total Philippine population technically remained fully financially excluded.

The report noted that the BSP was the first central bank in the world to establish an office, the Inclusive Finance Advocacy Staff, dedicated to financial inclusion.

It said the Philippines has been very active in taking leadership roles in international organizations for increased access to financial services.

To make financial services more accessible, the BSP is working with industry leaders to design governance and operational structures for a national retail payment system, which is being developed with the support of the US Agency for International Development (USAID) through the E-PESO project.

Moreover, the BSP is working on a draft national payment systems law and associated regulations. –Lawrence Agcaoili and Louella D. Desiderio (The Philippine Star)