Come ASEAN integration by yearend, the Philippines will have the most uninviting tax system in the region

MANILA, Philippines – The 19-year-old personal and corporate income tax systems of the Philippines are the “most uninviting and out of date” among the Association of the Southeast Asian Nations (ASEAN) economies, several economists said.

Even Finance Secretary Cesar Purisima agreed with other government officials and business groups that “it’s high time for a tax reform.” (READ: Big business groups to Aquino: Reform taxes)

“I’m not debating with you that there is nothing wrong with our tax system. Reform is needed. What I’m saying is we need to have a holistic approach,” Purisima told the audience of the 28th Philippine Economic Briefing in Pasay on Wednesday, September 30.

As the ASEAN region moves toward a borderless economic community, the Philippines will have the most uninviting tax systems among its ASEAN-6 peers should the government not implement a tax cut.

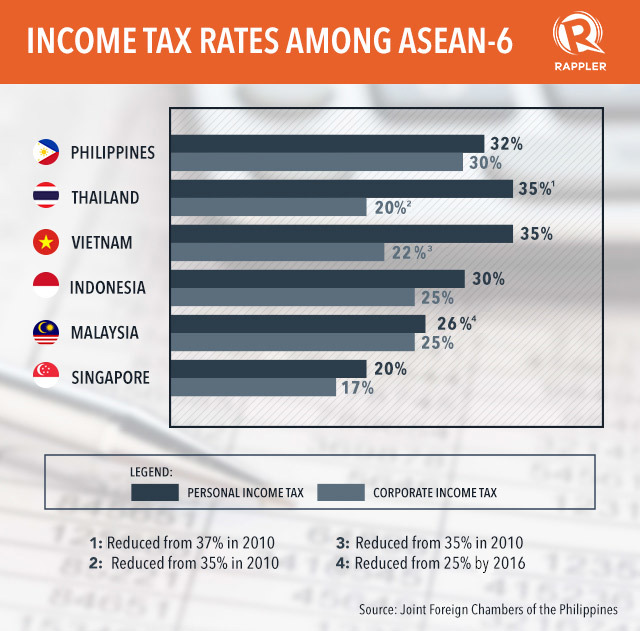

The Philippines currently has the second highest personal and highest corporate income tax systems among its ASEAN-6 peers. (READ: Lower income taxes? Aquino ‘not convinced’ it’s a good idea)

Economists explain why.

“The Philippines has been struggling with our fiscal deficit for some years now and one way to fix that is to impose hefty taxes on its citizenry and corporates. Thus we’ve seen tax rates increased to their current levels,” Bank of the Philippine Islands (BPI) research officer Nicholas Antonio Mapa said in an email.

Currently, the Philippines is the darling of the emerging market space with an improving fiscal sector.

“Tax collections are on the rise although slow spending has also yielded better fiscal numbers. But our neighbors with lower tax rates are now struggling to grow with [their] governments running gargantuan deficit to GDP (gross domestic product) ratios,” Mapa told Rappler.

“For example, we’ve seen Malaysia implement tax reforms (with the goods and services tax) to help shore up their fiscal picture as they suffer from a substantial deficit to GDP ratio of more than 4%,” Mapa said.

The Philippines, according to Mapa, now has the fiscal space, owing to “higher tax rates, improved collection, and sadly, slower state spending.”

“The challenge, thus, is for us to make proper use of this fiscal space to help increase our productivity down the line,” the BPI officer said. (READ: Prioritize public over credit ratings, Angara tells gov’t)

Government scared

Benjamin Diokno, University of the Philippines economist, echoed Mapa’s view, and said the government is scared that “rising deficit would cause a potential downgrade by international ratings agencies, hence the unchanged income tax system.”

He explained that in 2014, the Aquino administration targeted a budget deficit of P266.2 billion ($5.70 billion) or 2% of GDP. Actual deficit was only P73.1 billion ($1.56 billion) or 0.6% of GDP, and this is not because of higher-than-targeted revenue intake.

“The lower deficit was due to simple incompetence or poor budget planning or both,” Diokno, who is also the former budget secretary, told Rappler in an interview.

“The same horrible story is unfolding this year,” Diokno said.

“The Aquino administration is more afraid of the threat of a downgrade by foreign ratings agencies than incurring the collective wrath of Filipino taxpayers, who have to contend with the increasingly burdensome 19-year-old tax system,” he added.

For Purisima, the high income tax rate is to address the need for increased education and infrastructure spending.

“The need for education, infrastructure is increasing. When you look at the percentage of GDP, we spend lower for education than our neighbors. In the case of the Philippines, we only spend about 3% of GDP, while others spend 5% of GDP,” the Finance secretary explained.

“If we want to improve infrastructure, we need to put in at least 5% of GDP for many years. Same with education spending. So the point is, we need revenue to make sure we attain these growth targets,” Purisima added.

A call for uniform, equitable taxation

For Ronilo Balbieran, a research associate from Research, Education, and Institutional Development (REID) Foundation, having the highest tax rate in ASEAN-6 is not a problem in itself, as different countries would have their different fiscal policies and developmental goals.

“In our case, the Philippine Constitution mandates that we should have a uniform, equitable taxation, and that Congress should evolve a progressive taxation system,” Balbieran told Rappler in an interview.

“It will require thorough studies to answer whether we should lower or increase income tax. We should answer first whether we are hitting our productive capacity and how much does the government need to spend to achieve full utilization of our productive capacity of economy,” he added.

But Balbieran pointed out in an email correspondence that the unadjusted tax bracket under the Tax Reform Act of 1997 has to be addressed as soon as possible.

According to the Bureau of Internal Revenue, the Tax Reform Act of 1997 has this matrix of tax rates:

“We’re not imposing a 32% income tax across the board, but only to the supposed highest income bracket. But the income bracket has not been adjusted to inflation since that law has been passed,” Balbieran explained.

He added that “those who were presumed to be high middle class and rich in the 1997, and therefore taxed heavily, are not the same income class today. They may be very much poor and most especially the middle income class.”

According to Balbieran, the tax bracket “should immediately be revised to include automatic adjustments of nominal figures with inflation.”

“Moreover, I propose that the bracket be adjusted upwards to start high and end very high. In this way, genuine progressive tax system can be put in place,” he added.

For instance, Balbieran said a manager earning P500,000 ($10,704.85) annual gross income, is roughly taking home little less than P30,000 ($642.29) per month. He is already paying the highest tax rate, together with those earning to about P1 million ($21,407.76) a month.

“Thus, there is much room to lessen the burden of the ordinary workers and the middle class just by adjusting the bracket upwards, and make our taxation system competitive in pushing faster economic growth, even at the second to the highest personal income tax rate in ASEAN-6 for the highest income earners,” Balbieran said.

PH out of sync

The Philippines, according to UP’s Diokno, has not been quick to respond, unlike some of its neighbors such as Vietnam and Thailand which have reduced their tax rates to more attractive levels.

“Thailand in 2010 reduced its personal income tax rate to 35% from 37% and its corporate income tax rate to 20% from 35%; while Vietnam drastically reduced its corporate income tax to 22% from 35%,” Diokno explained.

“Singapore, which has the highest foreign direct investments among its neighbors, has even the most attractive income tax package: 20% personal income tax and 17% corporate income tax rates,” he added.

For the country’s former budget chief, “tax reform is urgently needed in this country.”

“The present tax system is out of date, inefficient, onerous, and out of sync with tax systems in integrating ASEAN region. Reforming it is a question of when not if,” Diokno said. – Rappler.com